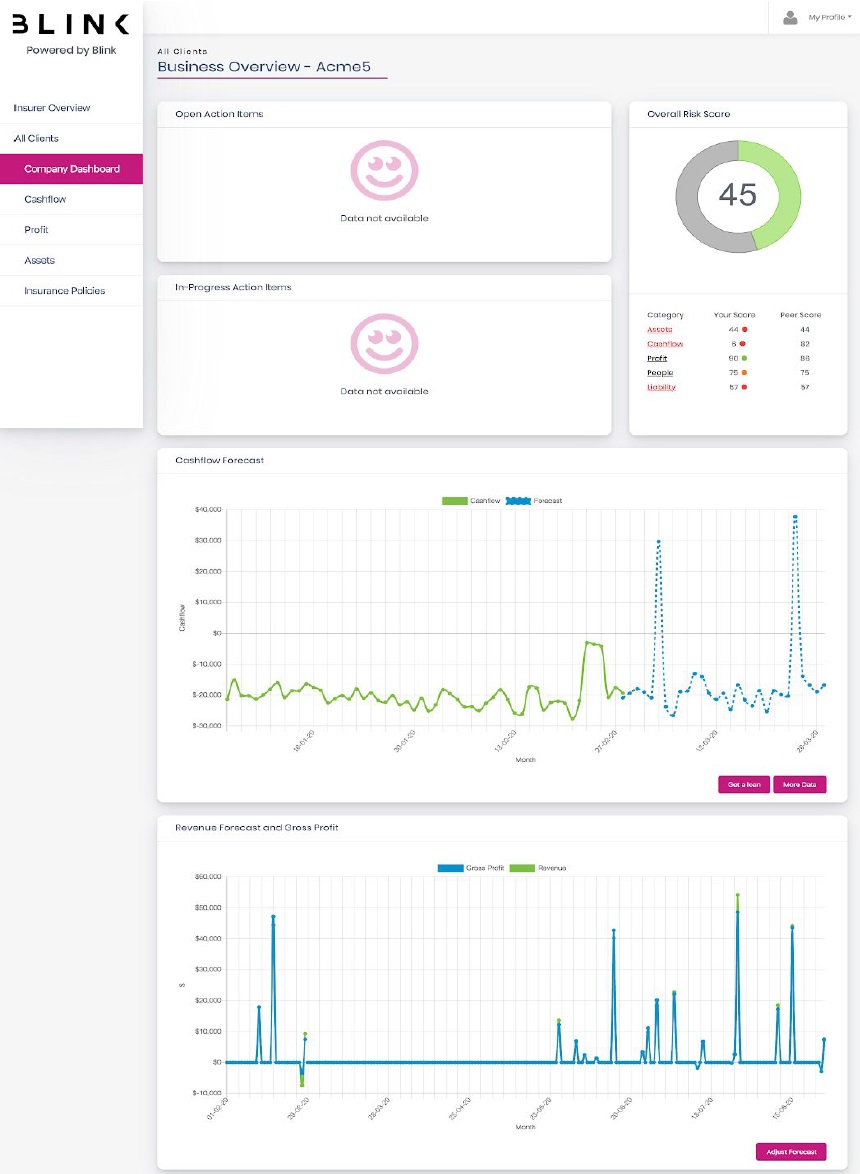

Due to the size and financial limitations of most SME, they do not have a budget to hire critical resources such as a CFO

Additionally, SME cannot identify their insurance gaps or cash-flow shortfalls in real-time to plan contingencies

Blink offers two digital platforms that can work together or independently depending on your business requirements.

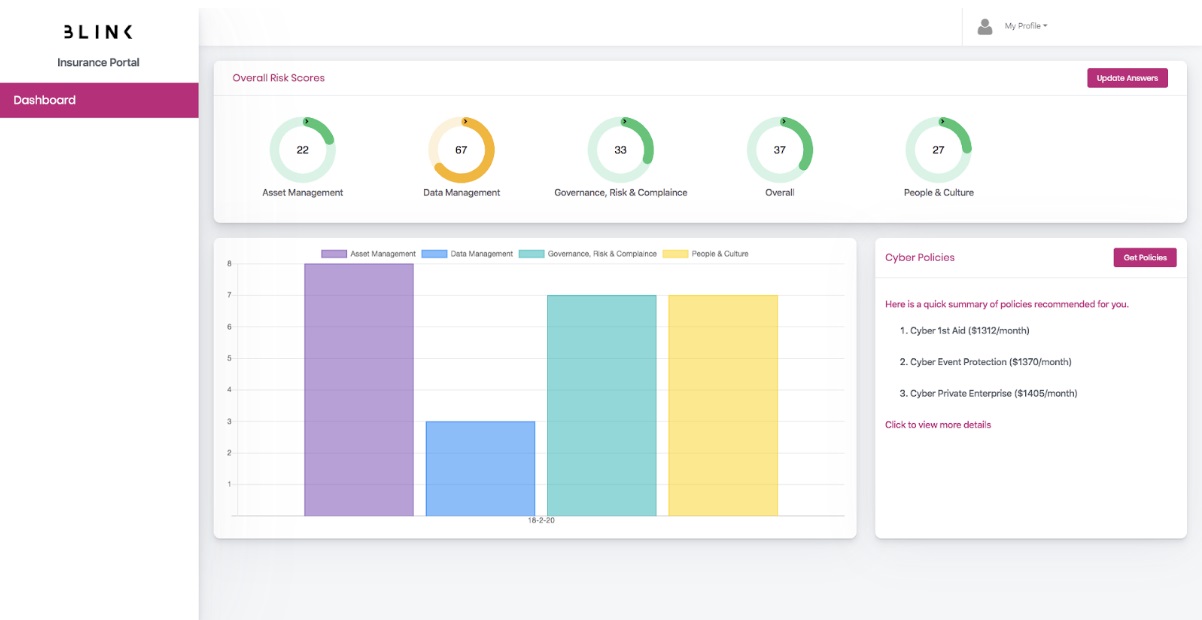

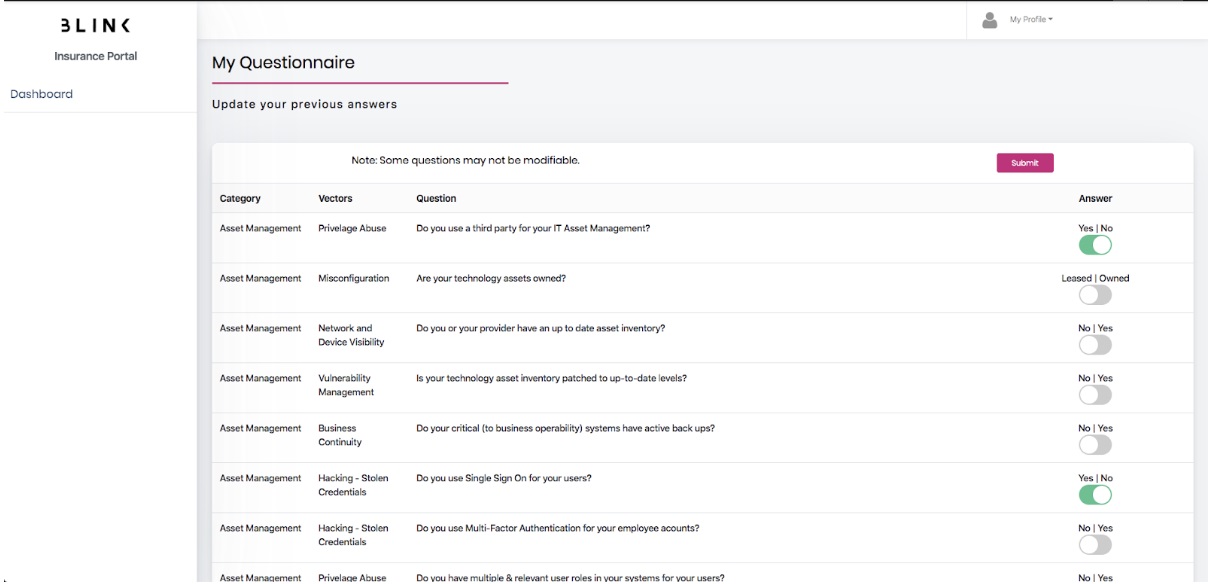

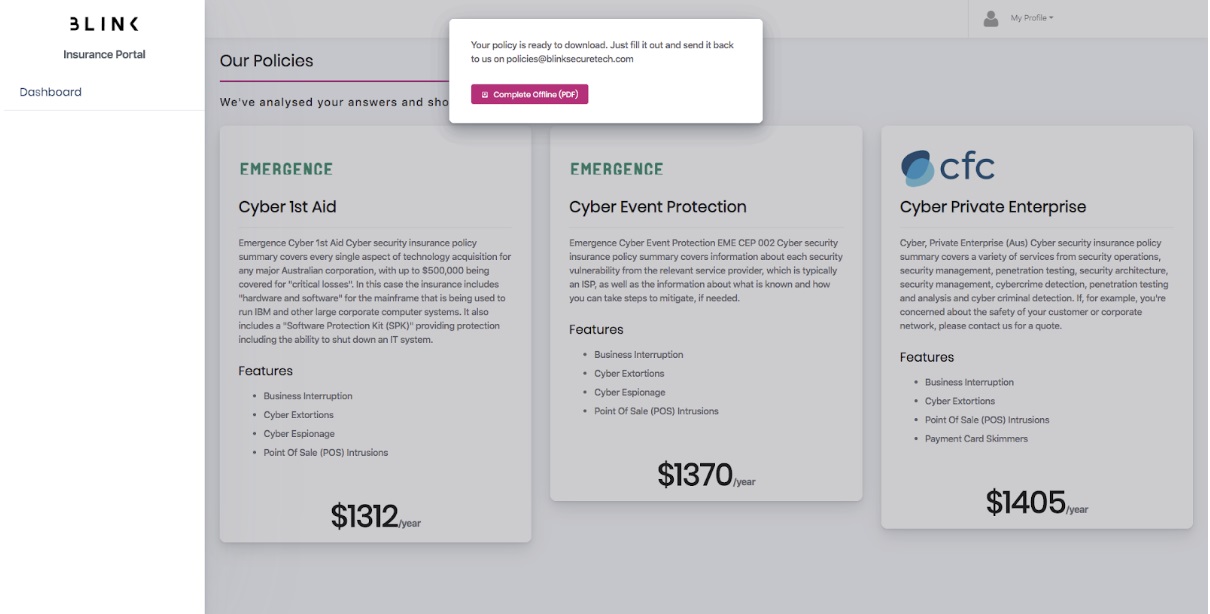

The second is our cyber platform which will give your business a real time risk score and help you select the most suitable cyber insurance product to protect your business and your customer data.

Through intensive analysis, BLINK has identified a gap in the marketplace

Comprehensively analyses and redefines insurance, business and financial risk for SME

BLINK uses propriety machine learning and artificial intelligence to identify risk specific to business, insurance and finance

SaaS Platform

Financial Advisors, Accountants,Insurance Companies and Brokers

SME – SMB (SME)

Platform can be branded and customised for “core customer” use

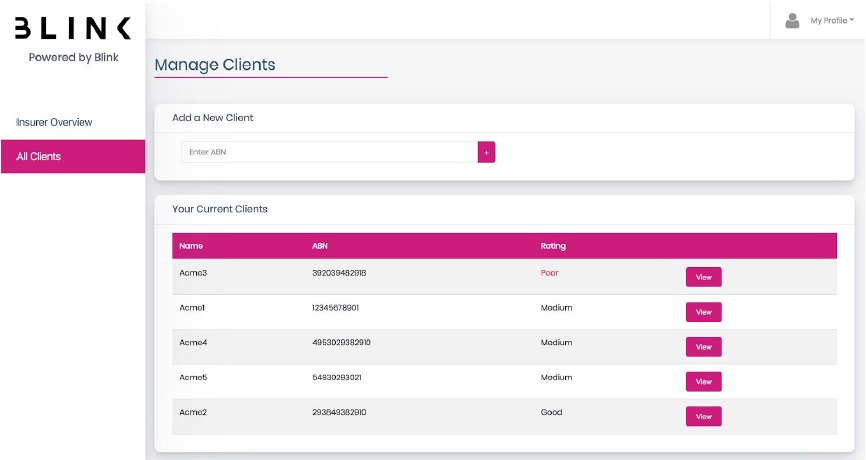

A digital business services platform which gives Accountants and SME the ability to receive real-time financial and business risk information BLINK extracts data direct from cloud accounting platforms, via an API and identifies the risk and then mitigates through our partner insurance and financial products

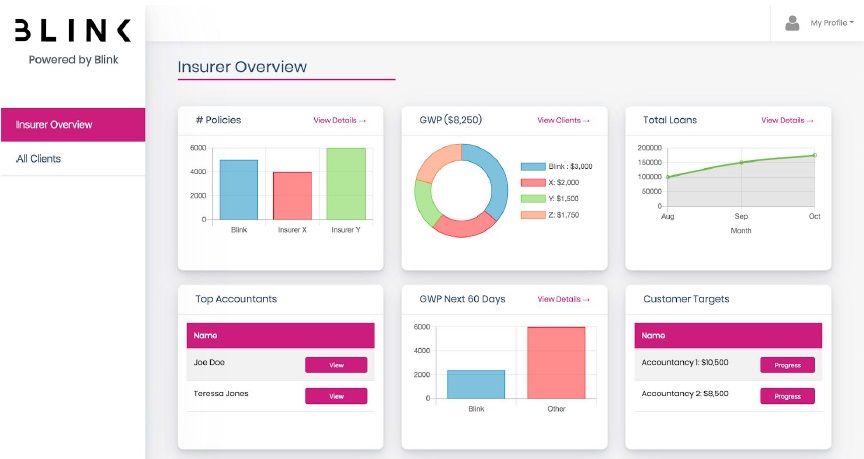

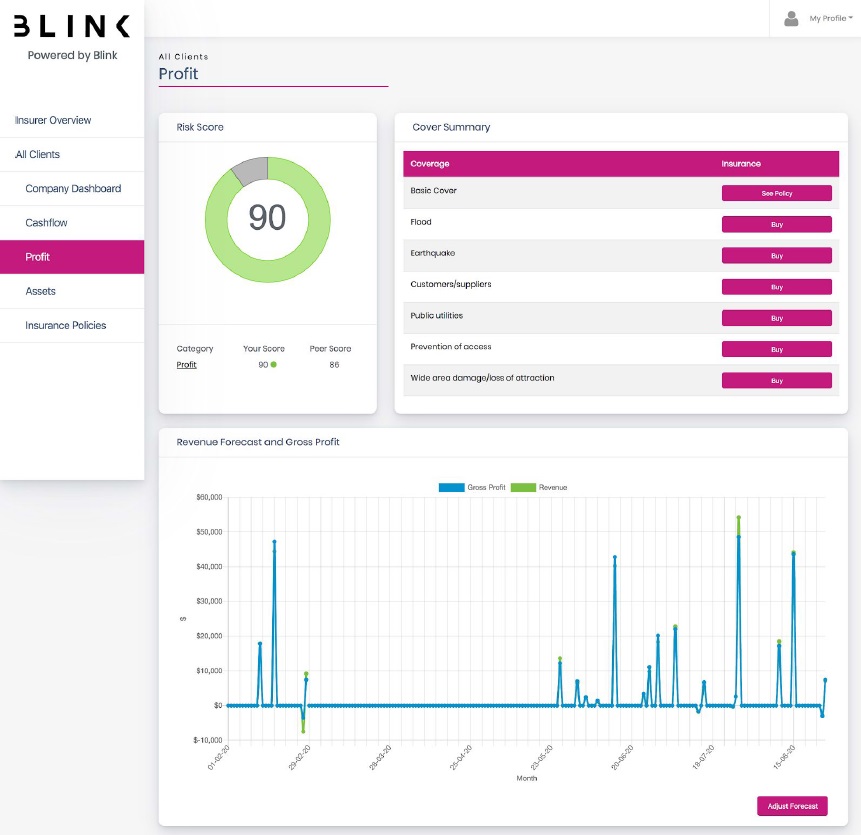

- Best fit insurance policy comparison

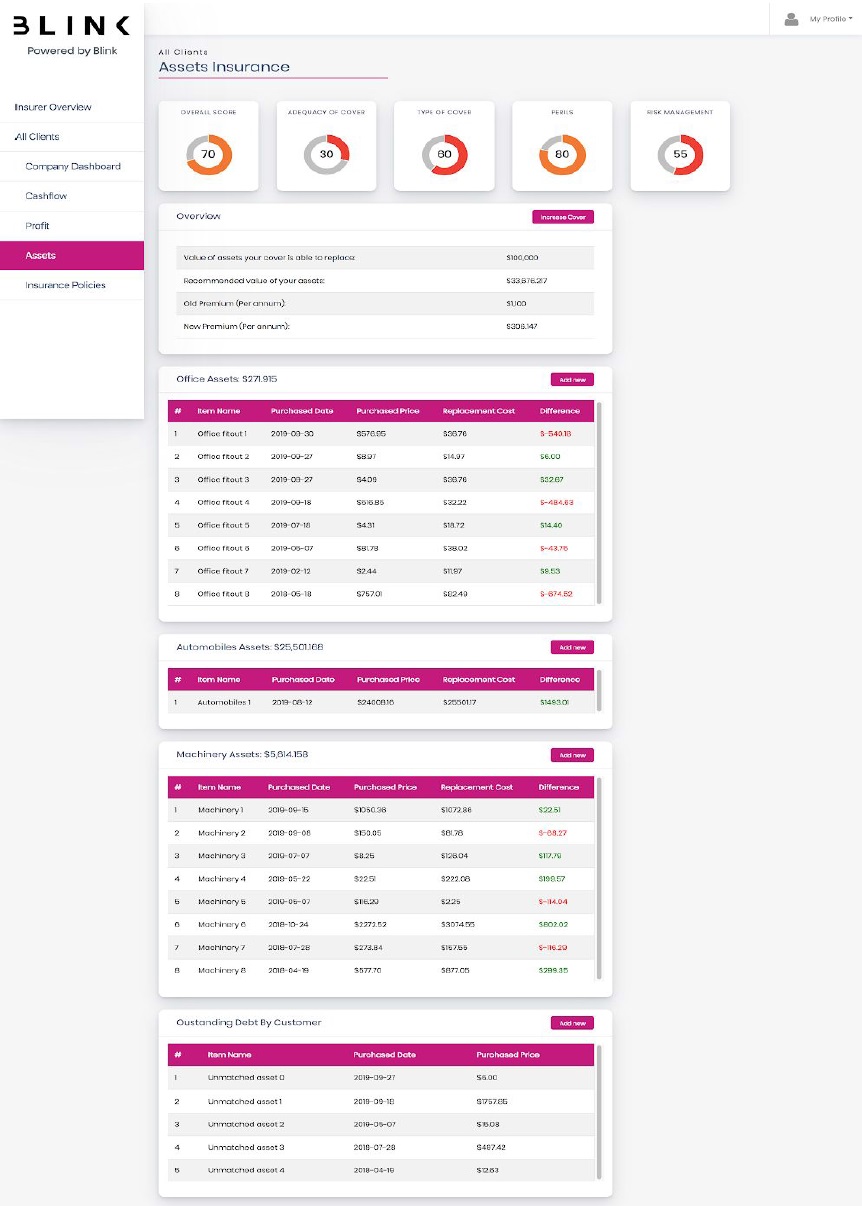

- Assets replacement comparison

- Financial and cyber risk scoring

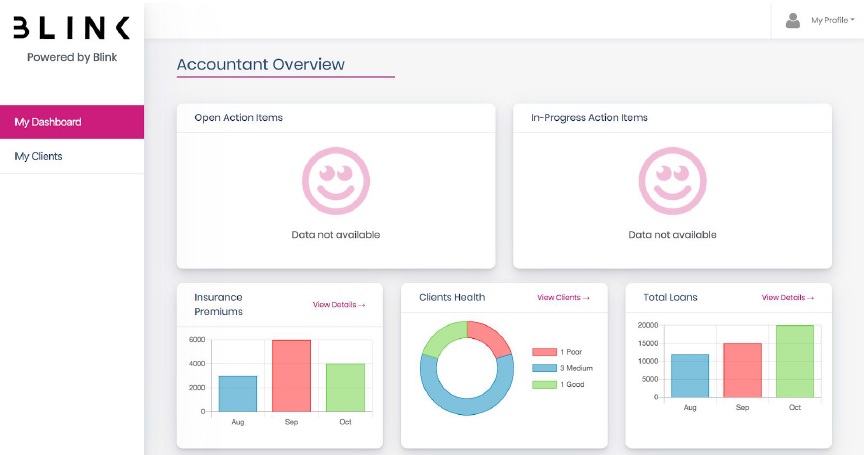

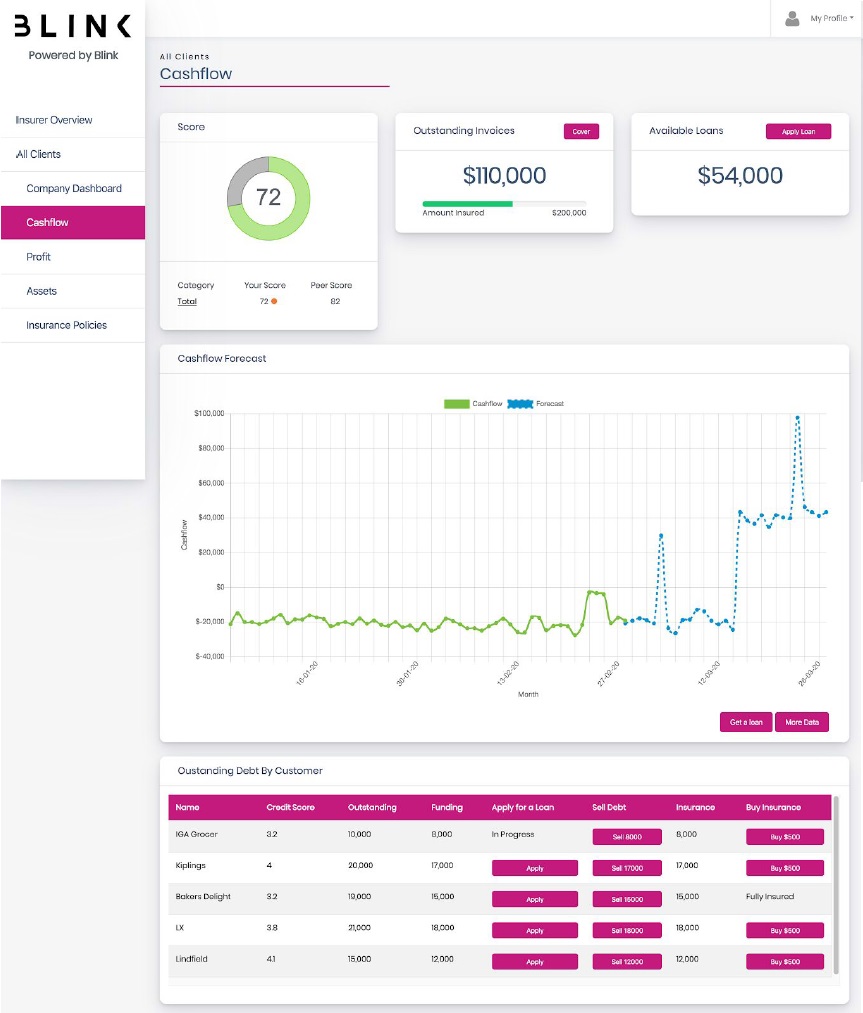

- Cashflow forecasting

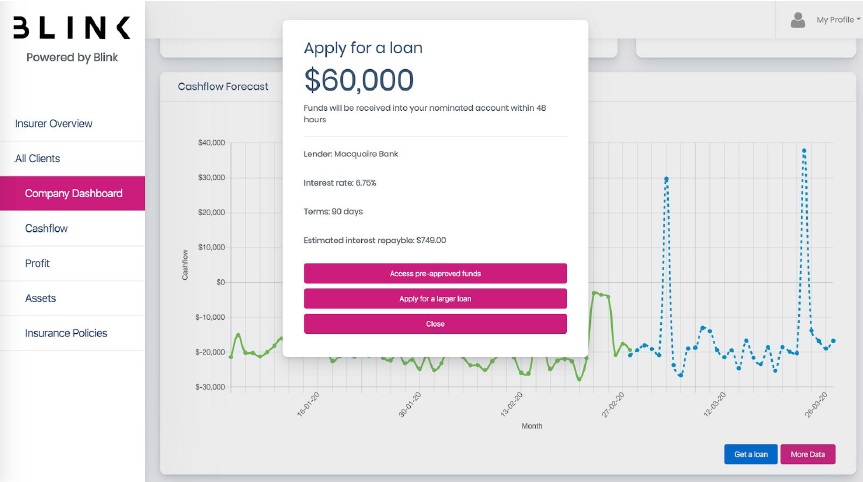

- Loan policy pre-population of application and approval facility

- Insurance pre-population of application and approval facility

- SME business evaluation questionnaire

- Basic CFO widgets

- XERO bi-directional real-time

- Accountant portfolio

- SME

- Insurer customer insights

- Asset extraction, classification and segregation into asset classes

Through API integrations and the latest in Machine Learning technology, financial data is transformed into actionable insights, delivered via an intuitive UI and protected by cutting edge security.

Through our API integrations we pull together billions of pieces of financial and performance data into one place.

Our ‘State-of-the-Art’ Machine Learning algorithms then get to work parsing and analyzing the data and identifying truths.

Through our intuitive UI we can present aggregated views at many levels from insurers and lenders to accountants and SMEs.

We employ the latest in cutting edge security technology and protocols to protect our customers and partners.